Slide Guide & Template

The Ask

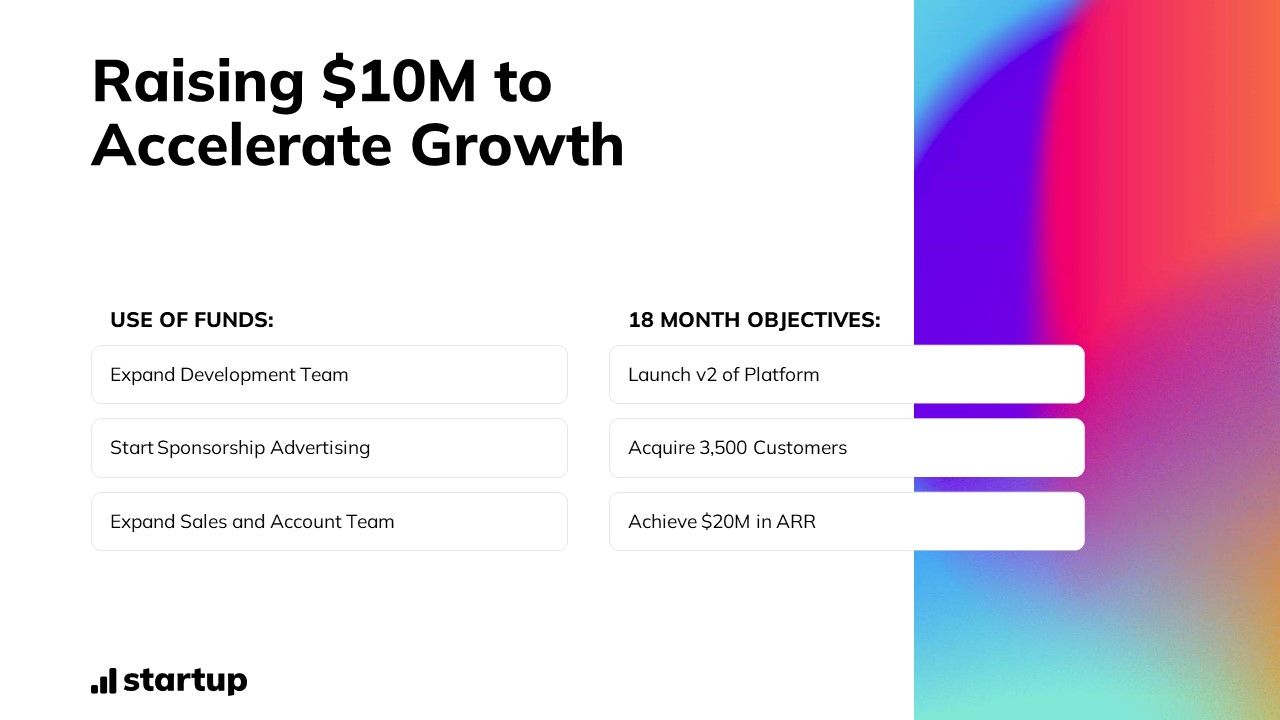

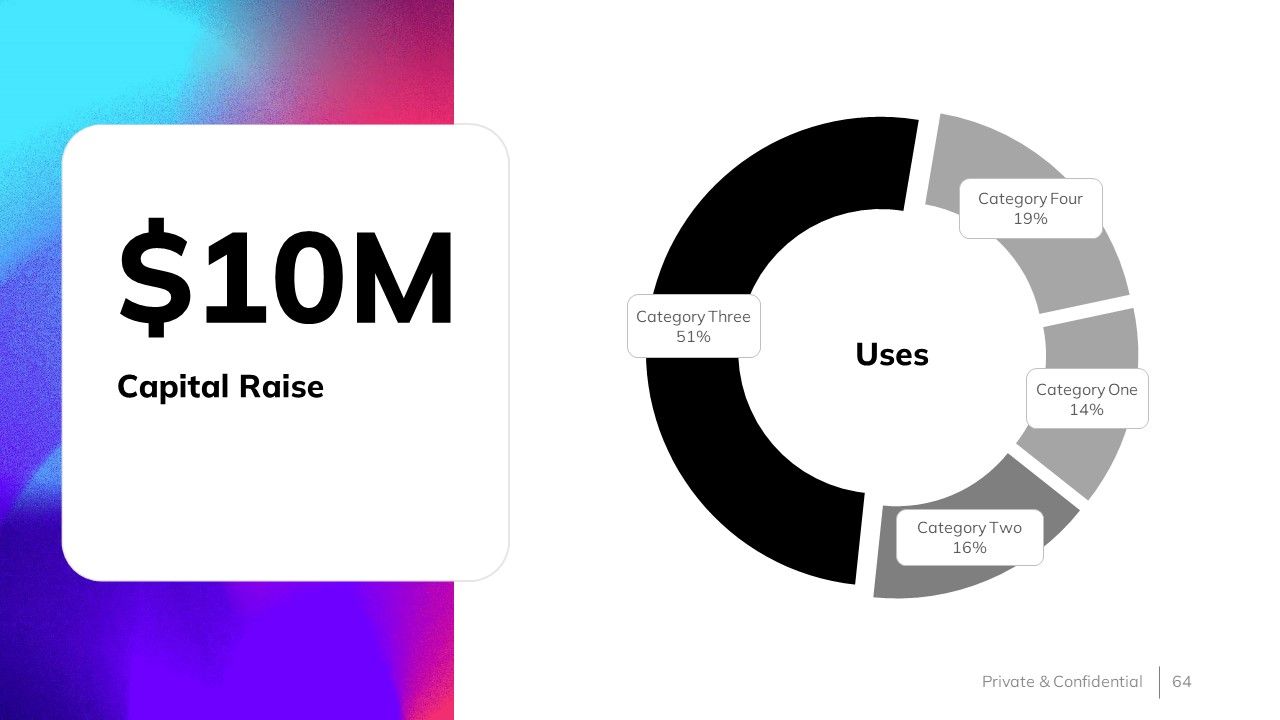

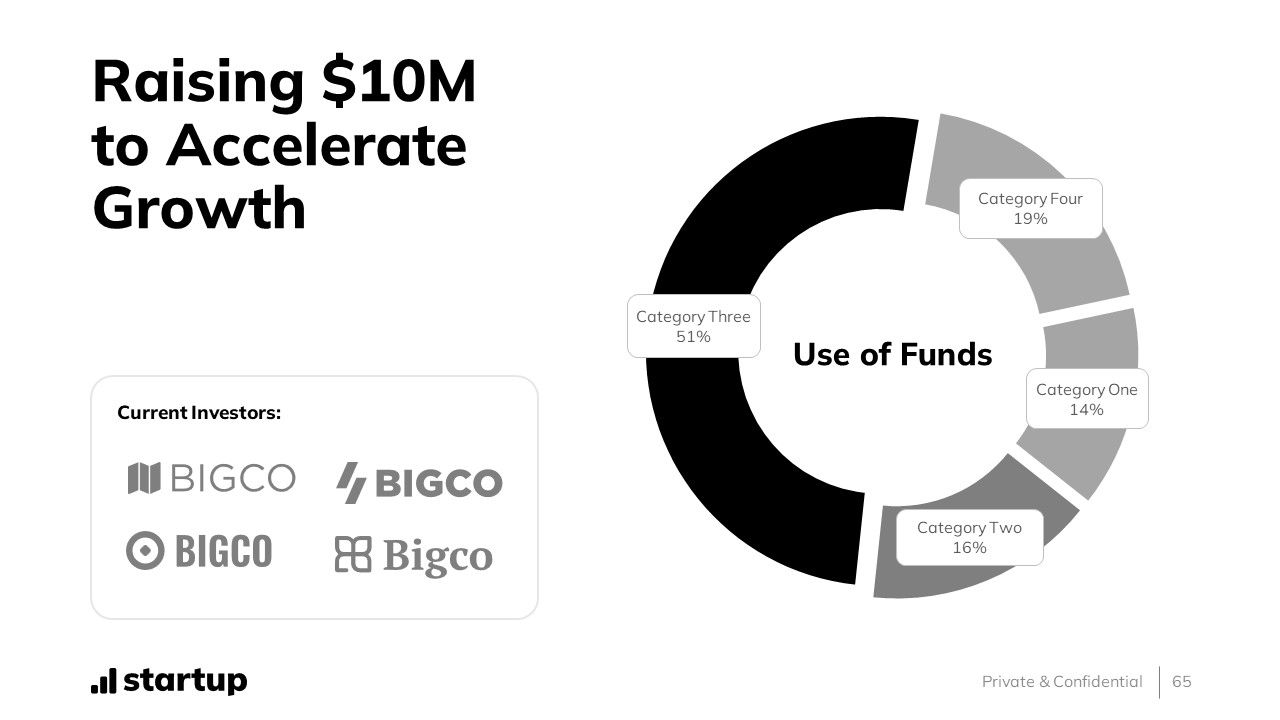

A good ask slide states your funding goal upfront, then dives into how you'll deploy that capital. Break down primary uses—product development, market expansion, key hires. Tie each to goal concrete, time-bound outcomes. "With $XM, we'll launch in X markets and triple MAU in 18 months." If you've got big-name investors already, drop in their logos. Most pitches shouldn't include an expected post-money valuation, that's for VCs to decide. Imagine if Apple tried telling the public market what their valuation should be.

When to Include It

Always. Otherwise are you really raising money? Should you even be reading this guide?

Where to Place It

At the very end. Typically after the financial forecast.

Ask Slides From Our Template:

Download Slides

© 2026 Superslates | LinkedIn | Site Terms | Privacy Policy